Ежегодно оформляя обязательную автогражданку, украинские водители с осторожностью поглядывают в сторону добровольного КАСКО. На сегодняшний день многие уверены, что данный полис актуален только в случае ДТП. Однако, это в корне неверно.

Список рисков, которые включены в договор КАСКО, гораздо шире. И подписывая его, владельцы транспортных средств получают надежного финансового защитника в лице этого полиса.

Какие риски покрывает КАСКО?

Каждая страховая компания в Украине предлагает автомобилистам разные программы обязательного страхования. Они предполагают полное и частичное включение возможных рисков. Основные из них – это хищение и материальный ущерб. Последний включает достаточно обширный список причин, которые могут повлечь за собой повреждение автомобиля. Это и стихийные бедствия, и противоправные действия третьих лиц.

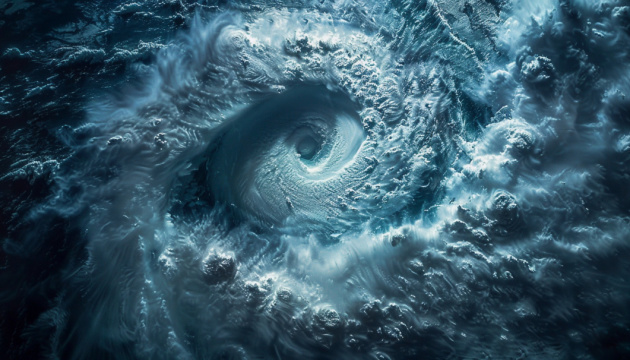

Очень важно перед подписанием договора четко обозначить перечень данных рисков, чтобы понимать, по каким из них вы сможете получить страховое возмещение. Например, стихийные бедствия в последнее время стали частой причиной повреждений транспортных средств. Включив этот пункт в договор, вы сможете рассчитывать на компенсацию в случае:

- повреждения авто градом;

- затопления в результате ливня;

- падения дерева из-за урагана;

- возгорания вследствие сильного ветра и обрыва линий электропередач.

Выбирая добровольное страхование, не стоит экономить на рисках. Никто не уверен, что ждет его машину завтра.

Во сколько обходится покупка КАСКО?

Чтобы говорить о стоимости добровольной автостраховки, важно учитывать большое количество критериев. В первую очередь, цена зависит от выбора программы. Так, КАСКО от Оранты предполагает наличие двух видов пакетов – стандарт и премиум.

Также важна характеристика автомобиля и водительский стаж его владельца. А, кроме того, есть критерий, который может позволить сэкономить на приобретении полиса. Это франшиза. В зависимости от ее размера, меняется стоимость КАСКО. Наиболее оптимальной считает франшиза в размере 0,5%.

Имея на руках данный полис, вы сможете быть спокойны за свое транспортное средство, ведь он является достаточно надежной финансовой броней. Его приобретение с лихвой окупается, когда наступает страховой случай. Так что необходимо основательно задуматься, стоит ли ограничиваться оформлением только обязательного ОСАГО или все же позаботиться о своем авто с помощью дополнительного полиса?

4391

4391